Financial freedom is a goal that many people aspire to achieve. It represents the ability to have control over your finances and live a life free from financial stress. While the path to financial freedom may vary for each individual, there are key principles and strategies that can help guide you toward this goal. In this article, we will explore some of these strategies under the following subheadings:

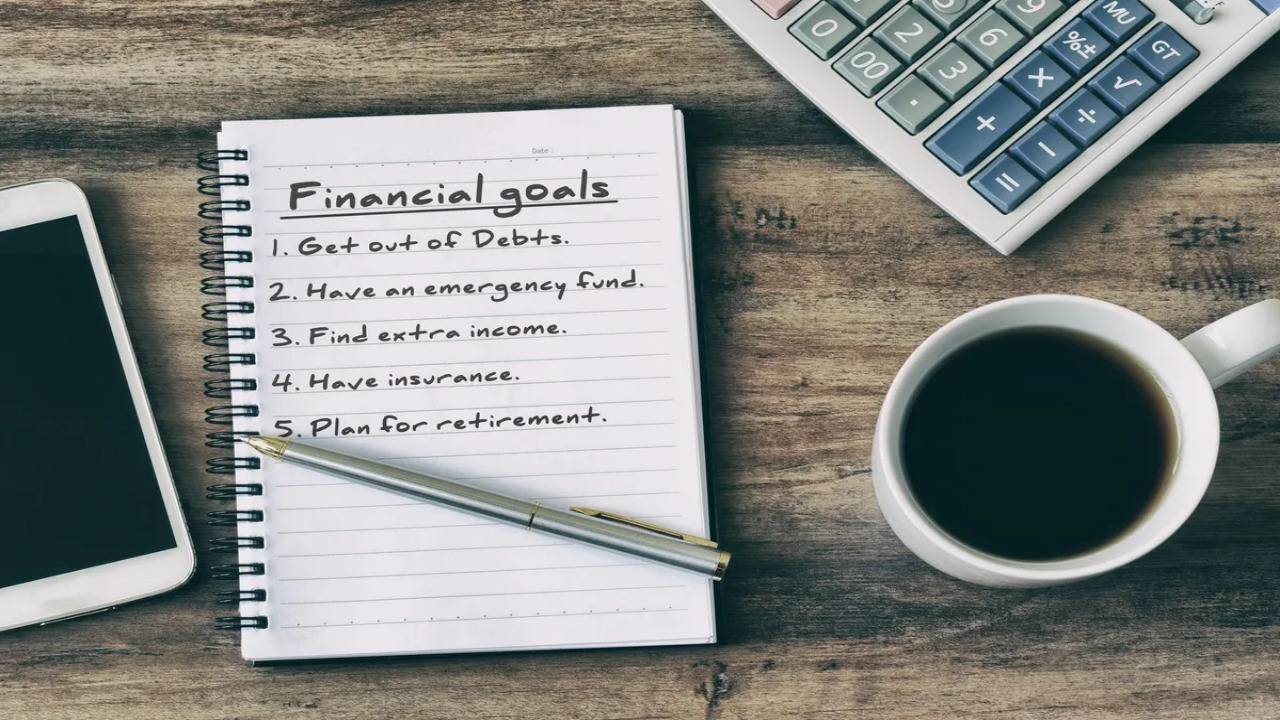

Set Clear Financial Goals

Setting clear financial goals is the first step toward achieving financial freedom. Start by defining what financial freedom means to you. Is it retiring early, starting your own business, or simply having enough savings to support your desired lifestyle? Once you have a clear vision, break it down into smaller, actionable goals that you can work towards. In addition, you can use this website to generate pay stubs for Ohio as well as other locations to make dealing with financial documents easier and quicker.

Create a Budget and Stick to It

Creating a budget is essential for managing your finances effectively. Start by tracking your income and expenses to get a clear picture of where your money is going. Categorize your expenses and identify areas where you can make cuts or save more. Allocate a portion of your income towards savings and investments, and ensure that you adhere to your budget consistently.

Pay Off Debt

Debt can be a major obstacle to achieving financial freedom. Develop a plan to pay off your debts systematically. Prioritize high-interest debts first, such as credit card debt or loans with high-interest rates. Consider strategies like the debt snowball or debt avalanche method to accelerate your progress. As you pay off your debts, redirect the money towards savings and investments.

Build an Emergency Fund

An emergency fund is a financial safety net that can provide peace of mind during unexpected situations. Aim to save three to six months’ worth of living expenses in a separate, easily accessible account. This fund will help you handle any unforeseen expenses without derailing your progress toward financial freedom.

Invest Wisely

Investing is crucial for building wealth and reaching financial freedom. Educate yourself about different investment options, such as stocks, bonds, real estate, or mutual funds. Consider diversifying your investments to mitigate risk. If you’re unsure about investing, seek advice from a financial professional who can guide you based on your goals and risk tolerance.

Increase Your Income

Finding ways to increase your income can accelerate your journey towards financial freedom. Explore opportunities for career advancement, seek promotions, or acquire new skills that can lead to higher-paying jobs. Additionally, consider generating passive income through side businesses, investments, or rental properties. Increasing your income provides more financial resources to save, invest, and achieve your goals faster.

Continuously Educate Yourself

Financial knowledge is a powerful tool on the road to financial freedom. Continuously educate yourself about personal finance, investing, and money management. Read books, attend seminars, or listen to podcasts on these topics. The more you learn, the better equipped you will be to make informed financial decisions and navigate the complexities of the financial world.

Stay Disciplined and Patient

Achieving financial freedom is a long-term journey that requires discipline and patience. Stick to your financial plan, even when faced with temptations or setbacks. Remember that small, consistent steps toward your goals can lead to significant progress over time. Stay focused on your vision of financial freedom, and keep pushing forward.

In conclusion, reaching financial freedom requires a combination of strategic planning, smart money management, and consistent action. By setting clear goals, creating a budget, paying off debt, building an emergency fund, investing wisely, increasing your income, continuously educating yourself, and staying disciplined, you can pave the way toward a financially secure and fulfilling life. Start today and take control of your financial future.